Save Time And Admin By Using Virtual Cards

Highly-knowledgeable travel experts, equipped with industry-leading tools.

The perfect blend of talent & technology.

Ever been Stuck Waiting for Travel Reimbursements?

Virtual Payments And How They Benefit You And Your Company.

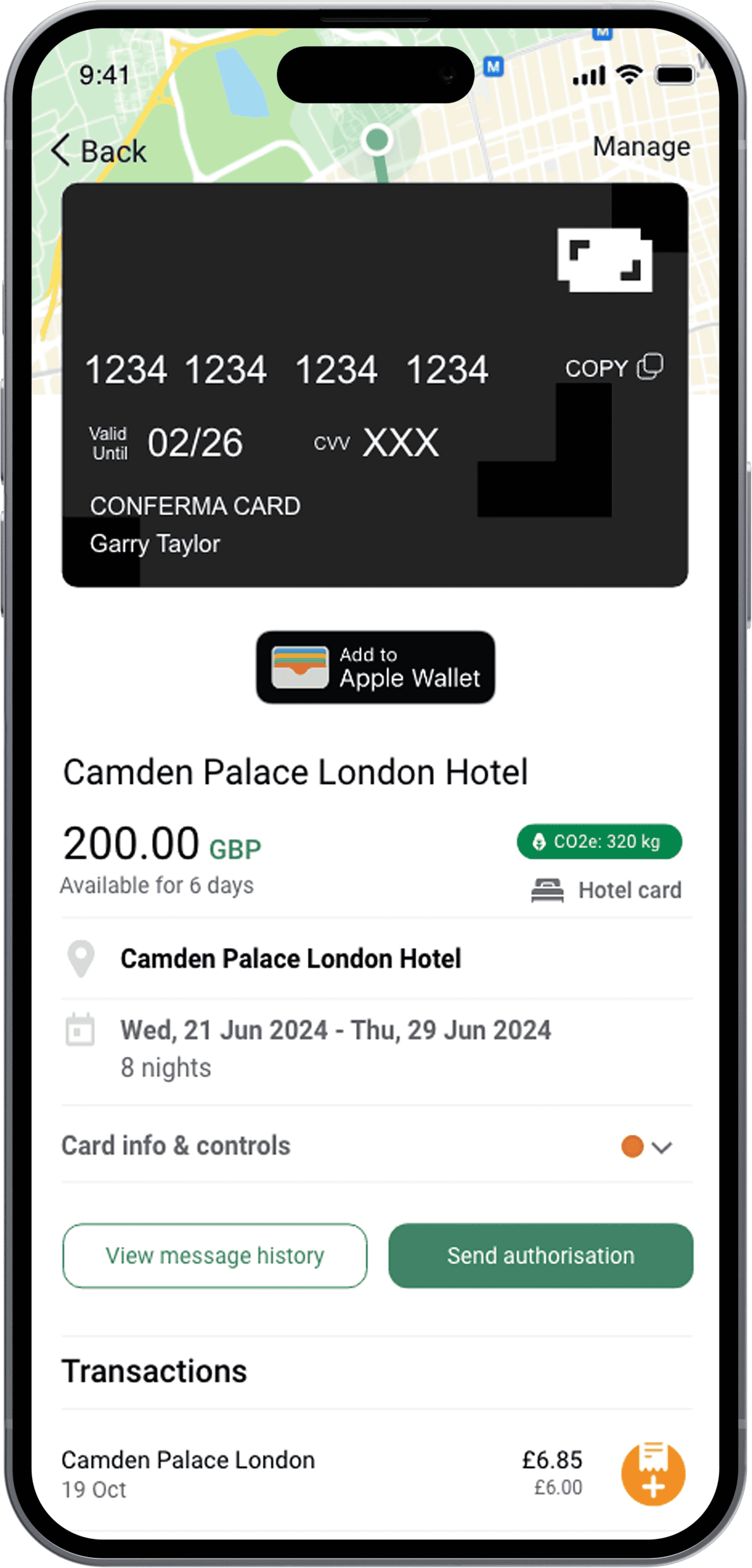

Just like a physical card, a virtual card has a normal 14, 15 or 16-digit card number which banking partners issue from their standard Bank Identification Number (BIN) ranges. Except that instead of being stamped physically across a plastic card, the number is unique to a specific transaction and is generated digitally at the point of sale.

Just like physical cards they also carry an expiration date, the cardholder name and a three or four-digit CVV or security code.

Travel managers place controls on how virtual cards are used — including the amount, date range and suppliers who can charge the virtual card. These usage parameters enable businesses to get better control, better data and improved efficiency over company spend.

Underneath all these benefits is the fact that using a card number only once gives every purchase its own unique identifier. This one-to-one relationship between purchase and payment, allows data to be added, customised and tracked all the way through the lifecycle of the booking without any additional work. The marriage of purchase and payment data collected is a powerful combination that automates reconciliation to 100%.

Ensure A Traveller Never Has To Pay For A Hotel On Their Card

Businesses don’t like issuing corporate cards to everyone who travels. Examples include new hires, interns, infrequent travellers, contractors and temporary staff. Virtual cards provide an effective way to allow these travellers to travel without complicated invoicing, bill-back, cash advances or reimbursement procedures. Corporate card programmes can be extended to book travel for non-employees and employees without corporate cards.

Virtual cards are generated at the point of booking, so the traveller does not need to worry about how travel costs will be covered. Payment is immediate, so there is no requirement for complex invoicing processes to be introduced and no one is out-of-pocket.

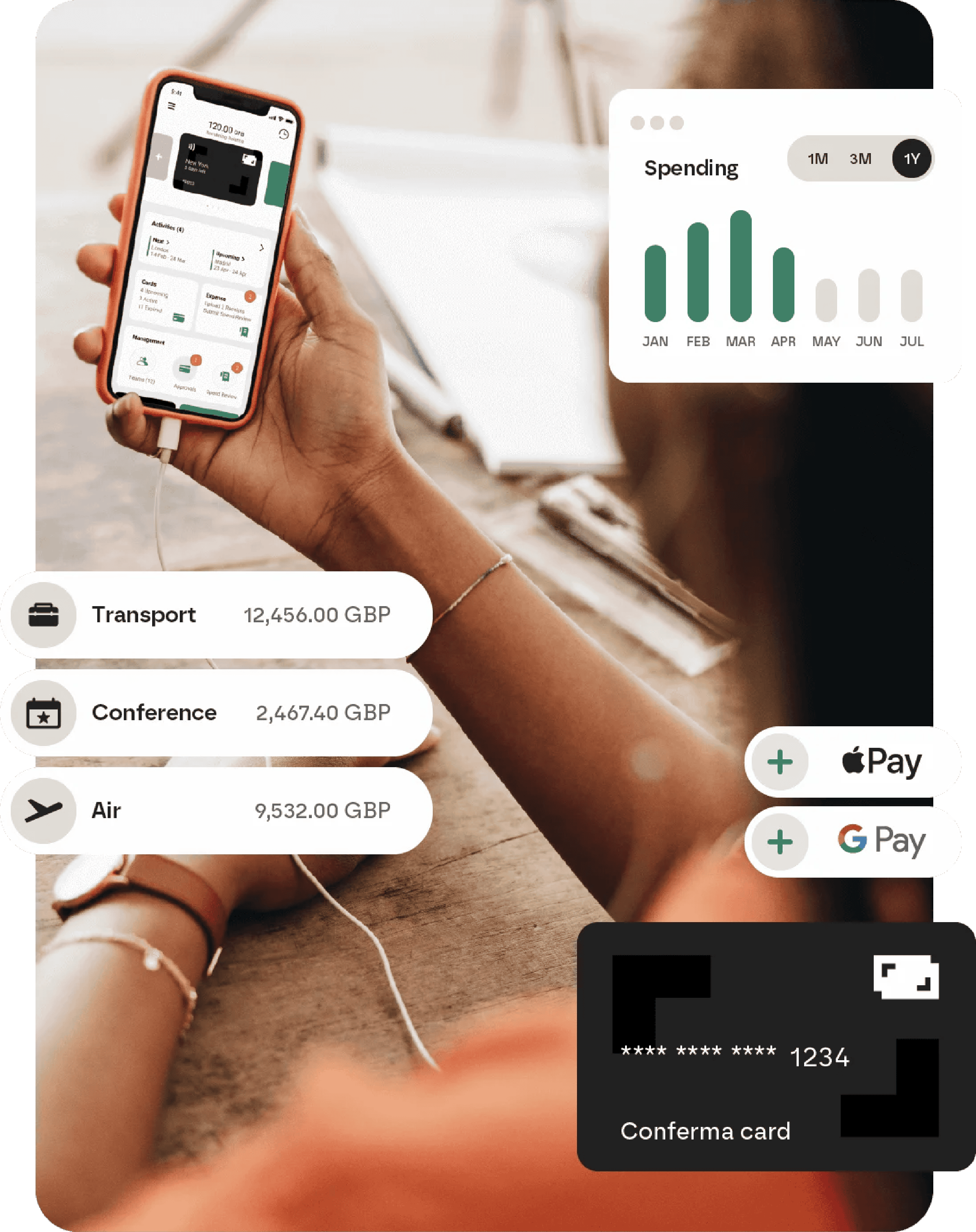

Corporate travellers cannot exceed the amount allocated on the virtual card so overspends are impossible. For companies that book travel through one of our integrated partners, hotel bookings and card details will show in the Conferma App. The traveller can easily access and confirm payment details wherever and whenever a traveller needs them.

Automate Invoicing And Reconciliations For Travellers

All companies dislike the lengthy manual chore of reconciling purchase orders and payment statements. Not to mention the added risk of human errors. Approve business trip spend upfront and receive a virtual card for each payment. With virtual cards, the unique payment number generated at point of sale means the purchase and payment are inherently reconciled as soon as payment is made. All transactions are matched to the correct individual with the correct trip, including cost centre, department or trip purpose. The Finance Manager feels in control and the traveller does not have to wait for reimbursement.

Avoid The Need For Multiple Credit Cards And Unnecessary Admin

With traditional corporate payments, the client receives a monthly statement containing limited detail (usually just supplier name, date of payment and total spend). Often, more time is needed after receiving the records to reconcile the payment data with the original booking data.

Whilst the traveller is waiting reimbursement for the items purchased using personal cash or card, the Finance Manager is piecing together the payment and transaction data. Some items sit in the TMC reporting, some in the corporate card statement and some items were purchased using the employee’s personal cash or card. Virtual cards can be used to pay any supplier which accepts card payments – from hotel bookings to airport parking.

All transactions processed via a virtual card are linked back to the employee and the trip. This removes the need for manual intervention as the paid amount is linked back to the booked amount. For finance departments, the process of matching and reconciling payments becomes a simpler task.

Create Cost Centres And Spend Limits

Virtual cards let you stay in charge without getting in the way of your employees. Apart from having to supply mandatory company information (such as employee number and cost centre), there are no new or different processes they have to go through to make a virtual payment. The generation of a virtual card provides an additional level of trip approval before the trip takes place. It limits the T&E spend per trip based on the restricted virtual card limit, as opposed to a corporate card with say, a £5,000 spend limit. As a payment is completed, the employee uploads a picture of the receipt for automatic reconciliation. All transactions are then auto matched to the correct employee and trip, including the department, trip purpose and cost centre.

Ensure Staff Stick To Travel Policy

For a corporate, policy controls are essential but they can be viewed as an inhibitor to a traveller, who just wants to be trusted to do the right thing. Virtual cards have control parameters like the card limit, merchant type and ‘life’ of the card, that are all pre-approved by the corporate. These controls allow you to monitor employee spending, not only to check for compliance but to ensure they are making the wisest buying choices.

Conferma Registration Guide

Features and facilities

– Available on Android and iOS devices

– Travellers can photograph their final invoice to make expense reconciliation easy

– Front and back of card visibility enabling users to present at hotel reception if needed

– Resend booking to hotel from device

– After check-out the VCN is removed from the App, so there is never any confusion or chance of the card being presented for another use

Read Our Quick Guide

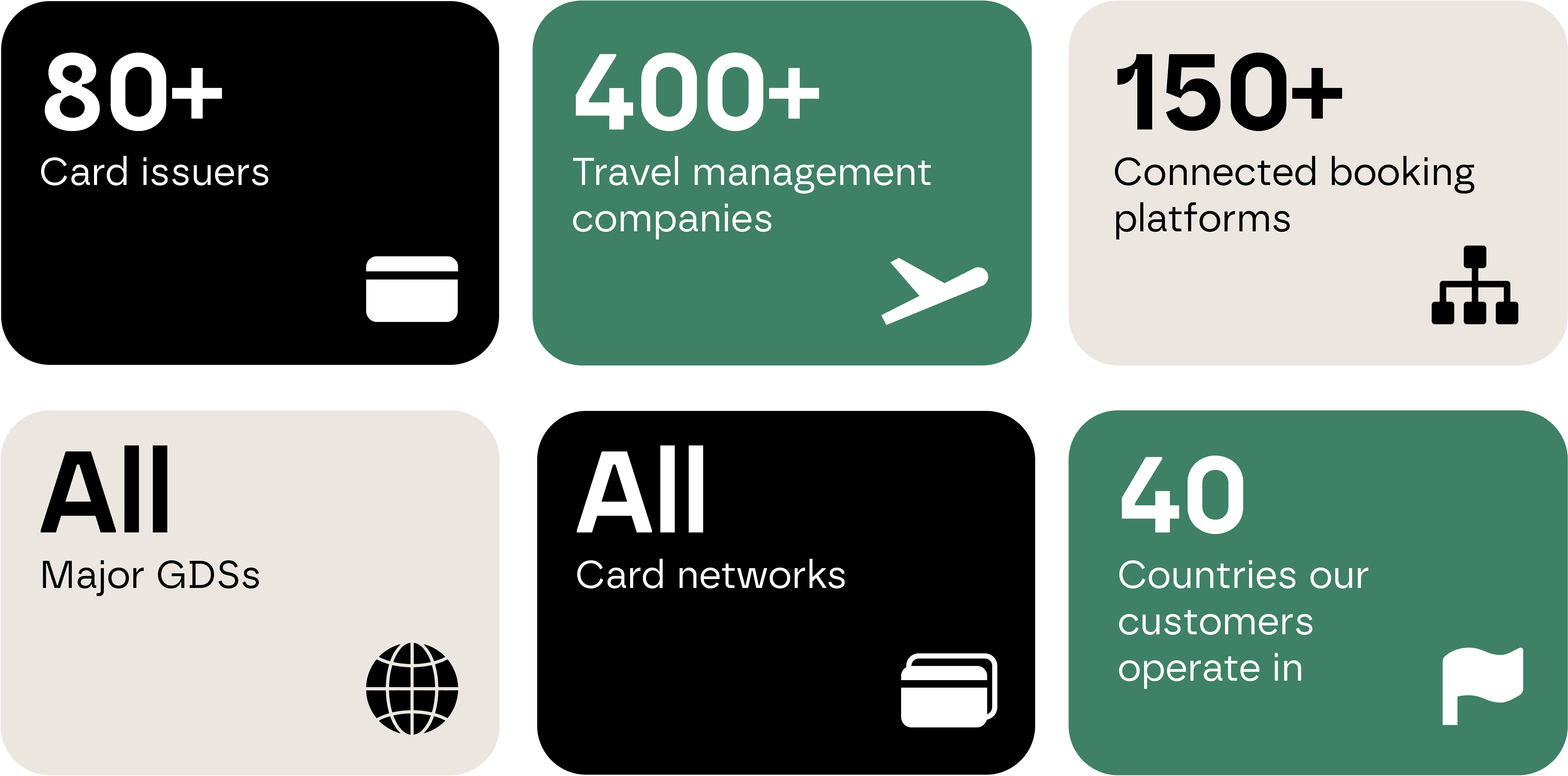

Conferma lets employees, contractors or interviewees and anyone in the business who doesn’t typically have access to a corporate card, use single-use payment cards for any approved corporate expense.